In a recent article, I used Google interest to get an idea of how we can compare the value of the WWE pay-per-view events in the era of the WWE Network versus those from before April 2014, which were offered only on traditional PPV.

If we go further into this analysis, we may begin to question whether launching the WWE Network how and when the company chose to do so was the smartest business decision. There are some unknowns, such as the value the Network may provide the company in a future media landscape. However if the theoretical PPV buys calculated here have credibility (see the previous article for a detailed explanation of the methodolgy of these calculations), then we can conclude keeping PPVs exclusive to traditional pay-per-view would have provided the company with greater profits, at least for now.

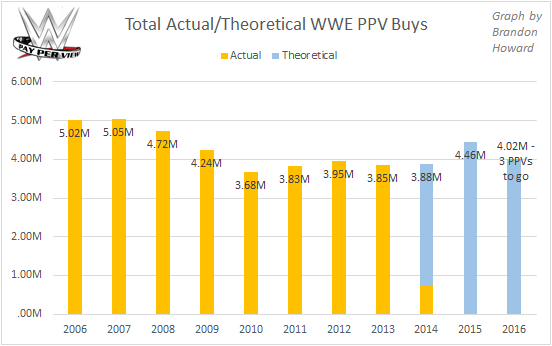

With three more PPVs in 2016 left to go, WWE is on track to hit about 4.8 million theoretical buys (based on the theoretical buys of Survivor Series 2015 and the two lowest-performing B PPVs from 2016), which would be the most total actual/theoretical buys in a year since 2007.

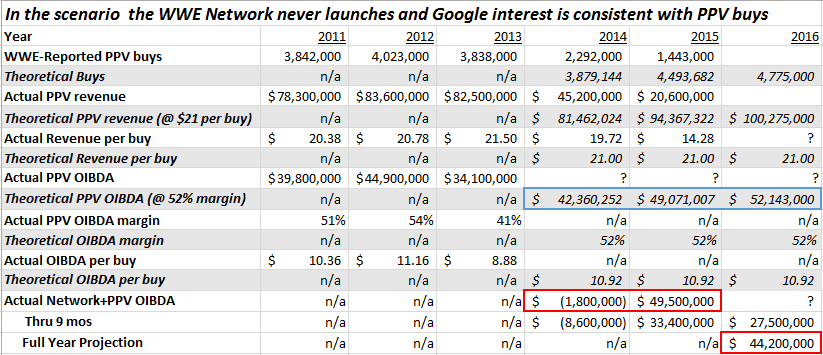

Of course because of their move into subscription live streaming, WWE barely generates revenue from individual PPVs like it used to. Before the WWE Network, the company was generating about $21 per PPV buy. Based on the Google interest generated around each PPV, it looks like WWE would be more profitable today if they’d stuck with traditional PPV versus moving all PPVs to the Network as they did in actuality.

Before the company started investing in the Network in 2013, it reported an OIBDA margin of 51% and 54% for its pay-per-view business in 2011 and 2012, respectively. OIBDA is WWE’s choice measure of profit. So we can imagine if WWE remained exclusively on PPV, the OIBDA margin for that section of its business would be about 52%.

In the scenario that WWE never launches the Network and draws 4.8 million PPV buys in 2016 (as theorized above), generating $21 of revenue per buy, that means WWE would earn about $100 million in revenue, and therefore $52 million in OIBDA (at a 52% margin). That’s likely more OIBDA than the company will generate in reality on the Network and the remains of its PPV business in 2016. Through nine months of 2016 WWE reported the Network and PPV division have earned $27.5 million in OIBDA. The company would need an unexpectedly huge Q4 performance for the Network to reach $52 million in OIBDA.

WWE projects the Network will have an average of 1.4 million subscribers for Q4. This implies the Network will make about $44.2 million in OIBDA for the full year of 2016. As you can see in the chart above, that’s less than this study predicts WWE would make if PPVs were offered only via traditional pay-per-view.

Compare the figures in the table above outlined in blue (the scenario in which there is no Network) versus those outlined in red (the actual scenario where there is a Network).

In our alternative universe without the WWE Network, where PPVs stay exclusively on pay-per-view and the theoretical buys based on Google interest are accurate, it appears WWE has missed out on considerable profits. This is particularly marked in the complete sacrifice of profits the company volunteered in 2014 to launch the Network and the abrupt transition of making all PPVs available on the streaming service beginning with WrestleMania 30 (April 6, 2014).

The Network has enhanced some revenue streams. It’s helped some stars get over. It’s unlikely NXT could become a globally-touring brand without the launch of the Network. Then again, it’s plausible the Network could’ve launched with only some PPVs while keeping some others exclusive to PPV while still giving NXT a platform to become strong enough to tour. Live event OIBDA through nine months of 2016 ($33.9 million) is already on par with the entire year of 2015 ($36.1 million). Even so, while it’s a nice supplement, the revenue from NXT live events likely only makes up a small minority of WWE’s live event business overall. Further, it’s questionable whether profits directly related to NXT are even enough to cover the costs of the WWE Performance Center and the downside guarantees of NXT’s talent.

WWE’s Home Entertainment business (mainly DVD sales) would almost certainly be stronger without the presence of the Network. That division fell nearly in half from $24 million in revenue in 2013 to $13 million in 2015.

By WWE CEO Vince McMahon’s own admission, the timing of the Network launch hurt the company’s ability to negotiate a favorable deal for U.S. television rights for RAW and SmackDown with NBCUniversal. TV rights are WWE’s biggest source of revenue and NBCUniversal is WWE’s most valuable partner therein, so who knows how many millions of dollars per year WWE has missed out as a result.

It’s possible the Network will pay off in at least one way still to be seen. WWE’s biggest TV rights contracts end in 2019. By the time new TV deals need to be finalized, it’s uncertain what the media world will look like. The company now can consider putting its popular RAW and SmackDown programming exclusively on its Network or joining up with a “bundle” of streaming services. It’s a somewhat radical to think about today: the prospect of RAW and SmackDown leaving traditional television, but nonetheless, having a strong WWE Network in its hand could be a powerful playing card to help WWE leverage better TV rights deals with partners that want to keep the wrestling programs on their traditional TV networks. Without a strong WWE Network, that theoretical leverage might not exist.