WWE Chief Financial and Strategy Officer George Barrios gave two public talks recently where he made some interesting comments about the top pro wrestling company in the world, including a dubious statement about talent contracts. He also gave some insight into WWE's business strategy as the company is in the middle a new round of TV contract negotiations.

WWE’s relationship with talent

On January 18 at the Needham Conference in New York City, Barrios commented in response to a question about WWE’s relationship with talent.

On talent contracts, the CFO said:

We're not specific about our talent agreements but generally what we like to say is it's a mutually beneficial association. So they're under agreements but both parties could terminate them in pretty short order. So we're not trying to lock anyone up. It has to work for both parties. And that model has worked for a long time and led to a succession of iconic stars, starting with Bruno [Sammartino], ending with John [Cena].

The notion of wrestlers being able to terminate their own contracts "in pretty short order" contradicts reports of performers like Rey Mysterio, Neville and Daniel Bryan, wanting to get out of their WWE contracts but being unable to.

Stephanie McMahon’s 2013 talent contract was made public in accordance with SEC rules. Section 11 is headed “Early Termination”. It states the promoter (WWE) can release a wrestler if WWE provides 90 days’ written notice:

11.1 (a) This Agreement may be terminated by PROMOTER during the Term for any or no reason whatsoever by providing WRESTLER at least ninety (90) advance written notice of said termination. The ninetieth (90th) day shall be defined as the “Termination Date”.

There is no clause that suggests wrestlers can simply terminate their contracts whenever they wish, as Barrios suggested.

Furthermore, 11.3(b) states:

Upon expiration or termination of this Agreement by PROMOTER pursuant to Section 12.1, WRESTLER shall not work, appear, or perform in any capacity for any professional wrestling, sports entertainment, mixed martial arts and/or ultimate fighting organization, promotion or entity not owned or controlled by PROMOTER (or any affiliated or subsidiary company thereof) in the United States for a period of up to one (1) year from the date of such expiration or termination, as specified by PROMOTER in the notice of termination; provided, however, that if no lesser period is specified by PROMOTER in the notice of termination, such period shall be one (1) year.

Other contracts obtained by the Professional Wrestling Legal Research & Preservation Group contain similar language to that of the Stephanie McMahon contract referenced here.

The one-year non-compete language is likely not enforceable. WWE already had issues with worldwide non-competes. In 2004, WWE was unable to prevent Brock Lesnar from performing for New Japan Pro Wrestling after granting him an early release to leave WWE and try out for a position with the Minnesota Vikings.

WWE surprised to learn Network subscribers actually wanted more in-ring content

At the TMT Conference In Las Vegas on January 9, as well as at the aforementioned Needham Conference, Barrios lauded new data analytics that the company now has access to thanks to 10 million user accounts that have been created directly on the company’s platforms like the WWE Network and WWE.com.

He mentioned WWE was surprised to learn Network subscribers wanted more in-ring wrestling programming, perhaps as opposed to programs like interview features, documentaries and reality series.

"One of the things that shocked even us when we launched the network is how much in ring content people were watching,” Barrios said. “They already have five hours live, RAW and SmackDown, on every every week. Well, those hardcore fans wanted more live [content].”

At both talks, he said it was because of the new data and WWE’s expanded analytics department that the company chose to run with programs like 205 Live, the WWE United Kingdom Tournament and the Mae Young Classic.

“We see the consumption of in-ring [content] even surprises us when we launched the Network,” Barrios stated at the Needham Conference on Thursday.

“So we've done the U.K. Championship, live. First time ever we've done a tournament outside the U.S. with non-WWE talent, just for that local market. We did the Mae Young Classic [to] find the next WWE female superstar. We started a new in-ring live show on the Network called '205 Live' for our cruiserweights. Things we would not have done without the use of data [obtained from] the Network.”

Optimism about WWE’s financial future

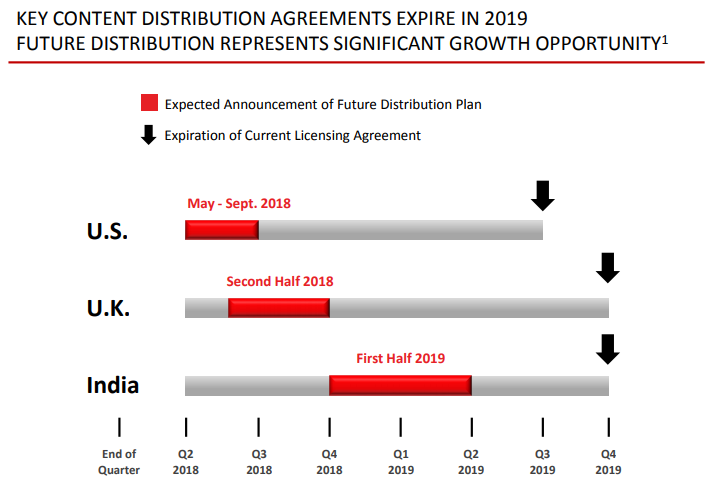

In Las Vegas, Barrios maintained that the company expects to announce a new U.S. television rights deal sometime between May and September of this year. The U.S. TV deal is WWE’s single biggest business partnership and is currently held by USA Network parent NBCUniversal. New deals with U.K. and Indian TV partners are expected to be announced in the second half of 2018 and the first half of 2019, respectively.

Source: WWE investor presentation, p. 26

Despite the run-up and fall of WWE’s stock in 2014, following the announcement of the current set of TV deals, financial firms seem sure the stock won't crash this time around. The stock price in 2014 roughly tripled in value within a few months, going from about $11 to as high as $30, then burst back down to the $11 range when TV deals were announced. The investor community was expecting increases on TV rights in the range of 2x or even 3x, but only received an estimated 70% increase. WWE CEO Vince McMahon admitted the timing of the WWE Network launch was also a factor in the disappointing TV rights deals.

The investment community is more cautiously optimistic about the prospect of WWE getting an increase from its major TV partners. A financial analysis from JPMorgan Chase expects a 1.7x increase “on the high end of what we believe are consensus expectations” for U.S. TV rights. There has been talk, reported in the Sports Business Journal, that FOX may make a bid for WWE whether or not it loses its deal to broadcast UFC. JPMorgan Chase speculates competition among networks could push WWE's U.S. rights to as much as 2x. Another analysis firm, BTIG, predicts a 1.3x increase.

Several firms are optimistic about WWE’s stock price which as of this writing is priced at about $33. These financial institutions have set the following stock price targets for WWE:

- BTIG: $36

- JPMorgan Chase: $37

- Guggenheim: $40

- Wells Fargo: $43

Besides TV, which is the company’s #1 source of revenue, there’s also optimism for the #2 area of business: the WWE Network. The company is openly considering tiering the Network: offering multiple price points, perhaps including a premium tier that would allow WWE to get more money out of each subscriber on average.

The company also believes it has great potential to fulfill over the coming years in international markets as well as through investment in social and digital businesses and in data analytics. Data, the company believes, will allow WWE to better understand and market toward its audience.

Barrios downplays India

In Las Vegas Barrios’ comments on India seemed to back down from any immediate penetration into that market for the Network.

“Actually the product [WWE Network] in India doesn’t work for a variety of reasons,” Barrios explained. “[Because of] the [$9.99] price point, it’s only available in English.”

Another problem is WWE pay-per-view events in India are currently available on the WWE Network as well as for free on TV on Sony Ten which also airs RAW and SmackDown, Barrios pointed out.

“And if you look at our [TV rights deal in India], we actually today license the pay-per-views, which is a big part of the value proposition… to our pay TV partner Sony.”

However WWE is expected to get an increase in TV rights from its deal in India, which is its #3 deal behind U.S. and U.K. The India deal could even exceed the value of the U.K. deal in the next few years. BTIG estimated that by 2020, WWE will be receiving $70 million annually for Indian TV rights, about double what the firm estimated the deal is currently worth.

It’s all real

Outside of his usual topics of conversation, Barrios was asked by a conference attendee in New York how much of the wrestling in WWE is real.

“It’s all real. We happen to know the outcome, but it’s all real,” he said as the audience laughed.

Barrios analyzed the WWE fan base as follows:

When you look at the tens of millions of people around the world who enjoy WWE, there’s different types of fans: some people can wax poetic on the technical abilities of different wrestlers. That’s one type of fan. There are others who are enjoying this grandeur, or the spectacle, the music, the lights, the artistry. There are some others who enjoy the storyline. So we’re a mixture of sports, rock concert, soap opera, a little Kabuki theater thrown in. Reality series. So different people enjoy different parts of it… And depending on who you ask, they probably want it to be more of the stuff they like, so that’s always a balance we’re having.

Brandon is a feature writer for Fightful.com. Email him at [email protected]. Follow him at @BrandonThurston. He co-hosts Wrestlenomics Radio, a podcast on wrestling business. A recent Patreon exclusive episode covered George Barrios' talk in Las Vegas.