The brand split is paying off.

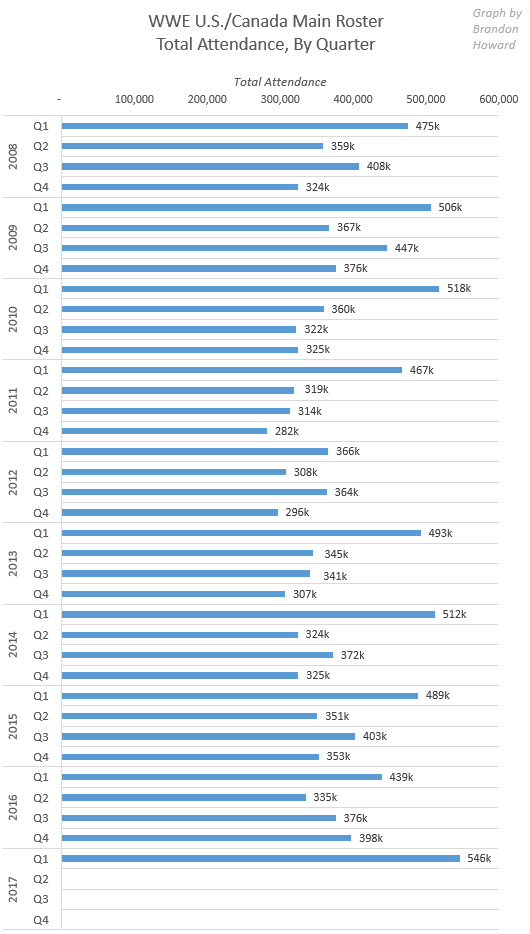

WWE reported its first quarter earnings yesterday. With the company's touring schedule more fully divided into RAW and SmackDown rosters in Q1, the company's total attendance is at its highest point since at least 2008. Average attendance however remains the about the same.

"[Live attendance has] always been one of my barometers [to measure success] since day-one," said WWE CEO Vince McMahon, "and we've increased our attendance by over 100,000 in the quarter compared to last year [in the same quarter], which is pretty amazing."

The brand split is allowing the company to run more events, holding 91 in Q1 compared to 75 in the same quarter last year. Those event and total attendance counts are for RAW and SmackDown live events only and do not include any NXT events.

Q1 is always WWE's best quarter for total attendance but this year's Q1 was the highest in at least a decade.

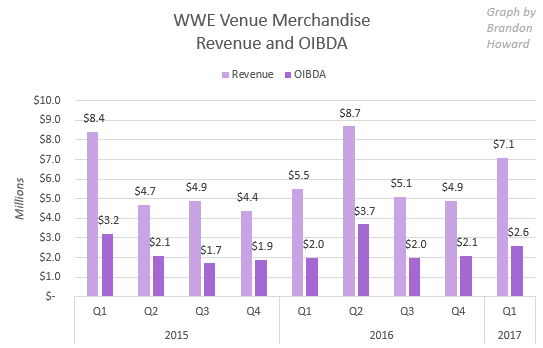

More fans going to events translates into more merchandise being sold at venues. The Venue Merchandising segment, which has thrived in recent years, earned $7.1 million in revenue and $2.6 million in OIBDA (a measurement of profit) compared to $5.5 million and $2.0 million, respectively, in Q1 2016.

At events in the U.S. and Canada, attendees during the quarter spent an average of $10.09 on merchandise, identical to Q1 last year. Online, fans are spent an average of $45.48 per order, up slightly from $43.56 for the prior year quarter

TV Ratings

(Source: WWE Key Performance Indicators)

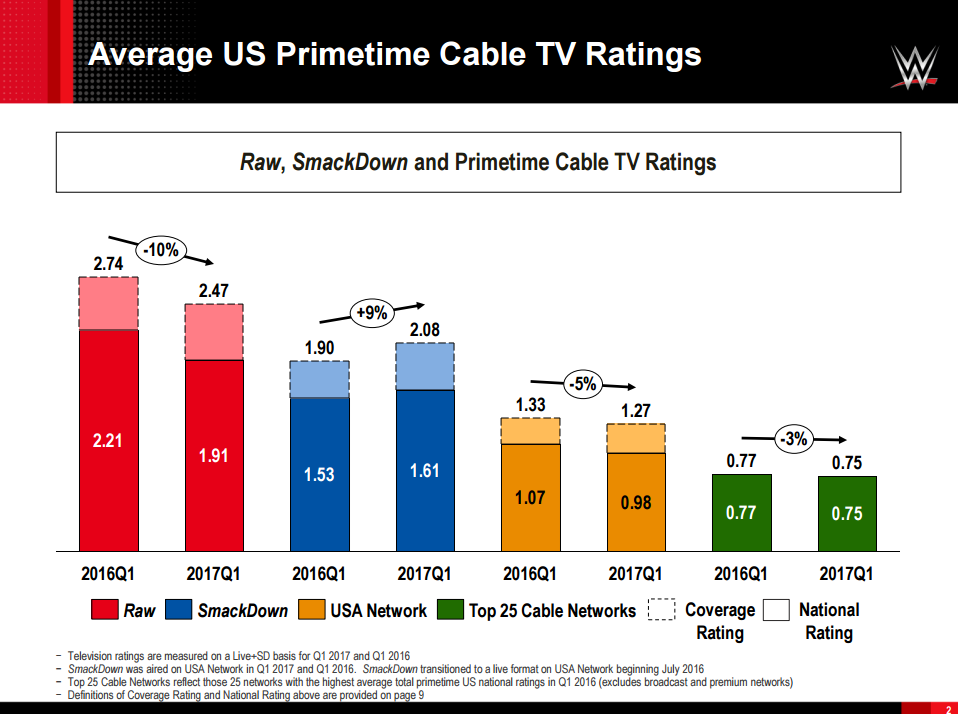

SmackDown TV ratings are up 9%. RAW's ratings are down 10%, performing worse than the primetime viewership for USA Network or the top 25 cable networks.

I view this as a net win for the brand split. Without the brand split, RAW would still be down, maybe less so, but suffering close to the same degree. And if it were still a B show with the same roster, SmackDown would be down as well, rather than up. That SmackDown has been able to improve its ratings in this media environment should be looked at as a genuine success. The issues with RAW however are another story.

One stock analyst on the investors' conference call asked WWE Chief Financial Officer George Barrios why RAW's ratings were down and what the company can do to improve those ratings, an issue that may or may not be detrimental when the company renegotiates its major TV rights contracts in 2019.

Barrios' answer didn't amount to much:

We have great talent. They're split among these two great brands [RAW and SmackDown]. From time to time one may be doing a little bit better than the other, but back to Vince's point about the long-term: we don't worry so much about this month or this quarter if over time we're driving that level of engagement, especially relative to our peers on the platform, we're excited. We're excited about the storylines on RAW and we're excited about the storylines on SmackDown.

He didn't mention that the year-over-year increase we're seeing in SmackDown's ratings will run out as soon as we hit July: the point last year when the brand split began and the program switch to a live show on Tuesdays. Since the brand split, SmackDown's ratings have jumped up, but they have declined from that shot in the arm received at the draft.

RAW's traditional TV viewership continues to be hampered by its long run time, with the third hour almost always being the least-viewed of the three. Even so, RAW continues to be one of the highest ranked programs on cable on its night, usually in the top 10 if not the top 5.

Super Fans and the General Audience

Vince McMahon was directly asked by another stock analyst on the call whether WWE is more working on expanding its overall audience or whether it's more concerned with driving more and more money out of its passionate fans. McMahon after an opening statement usually tries to stay pretty quiet on these calls and leave the business talk to Barrios, who was also joined by this time Chief Marketing Officer Michelle Wilson. There's an old school promoter-and-booker dynamic between Barrios/Wilson, who seem to lead the business side of the company, and McMahon, who of course leads creative.

McMahon's explanation of his goals to monetize his audience was unfocused:

[T]hrough Stephanie [McMahon]'s efforts and Michelle [Wilson] and corporately, there's a huge effort on our part to grow our base. And you can start to grow the base, and you continue to grow the base as far as women is concerned. Again, they're the gatekeepers many times to programming and what have you and likes of whether or not they enjoy the brand. There's an initiative now and has been for a while, the initiative is everyone is trying to get the younger audience. One of our secrets of course has been generation after generation. So again we continue to broaden our platforms on an overall basis. And at the same time, as Michelle and George were talking about, we capitalize on the data we do have and our current super fans.

Throughout the call WWE's executives stressed that, thanks to the Network and the personal data each subscriber submits when creating an account and the data generated from their viewing habits when they actually use the Network, the company is provided with a wealth of information about its fans. WWE says it's using that information to enact "customized marketing" and to decide what kind of programming to put on the Network.

"[We use] custom messaging on what other programming to [direct subscribers] watch, new programming that's coming, what that subscriber is tending to watch," Wilson said. "So again really customized marketing is our goal on a one-to-one basis."

Later in the call she mentioned the data is telling WWE that fans want more in-ring content.

"What we're finding is that obviously localization, more in-ring content is what [Network subscribers] are looking for and we are able to produce that incredibly efficiently."

3 to 4 Million Subscribers Remains the Goal

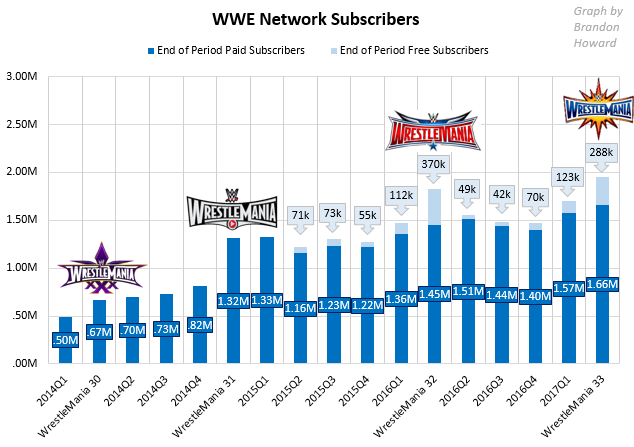

Barrios reiterated the company's lofty long-term goal of 3 to 4 million paid subscribers for the Network.

As of WrestleMania the service had 1.66 million paid, with an additional 288,000 on a free trial.

"We just missed 2 million [free and paid subs, total] which we were hoping for," McMahon said.

Barrios suggested that someday, presumably in the distant future, the Network will be the place where all WWE content is consumed.

Over time we believe the [WWE Network] will expand to include the entire WWE ecosystem. So it won't just be direct-to-consumer for video content. It'll be direct-to-consumer for all of WWE. So that to us is really, really strategically important. And then when you get to mile markers, we still think over the long arc of time we can get to three to four million subscribers on the Network and as long as we're growing year-over-year we feel good about the progress.

He didn't mention RAW and SmackDown by name but that certainly sounded like what he was referring to. Still, WWE's TV rights negotiations come up in 2019 and I wouldn't expect RAW or SmackDown to leave cable at that time.

If a day comes when RAW and SmackDown are on the Network, it would serve as justification to increase the subscription price or to offer multiple pricing options, where perhaps RAW and SmackDown would be offered on the most expensive tier but not on cheapest tier.

"We continue to research [tiering] and evaluate it." Wilson said. "No specific timing that we're ready to announce yet."

Jinder Mahal

Jinder Mahal, not by name, was brought up by another analyst on the call. The executives were asked whether "one of your Indian wrestlers from the roster" who's "getting a big push" was a strategic move related to the company's ambition to break into the Indian market.

Barrios downplayed that the booking decision as related to Mahal's ethnicity, however, saying: "We're all human beings and there's a certain level of ethnocentrism when a local character's really popular it kind of pushes up in that country maybe a little bit more, but we let the storyline drive who's hot or not, as opposed to one specific geography, but it certain doesn't hurt in India."

Whether Mahal's push correlates to any increase in interest in India is unclear. Videos on YouTube featuring Mahal were more modest this week after an uptick in previous weeks. Barrios said on the call that India is the company's second-largest market on digital sites like YouTube.

As we move forward into the future I would expect WWE to feature more wrestlers from markets they wish to gain a following in. There's a reason the company has made strong moves to recruit talents from China, which is the other big untapped market along with India.

Follow Brandon on Twitter @BrandonThurston. You can reach him by email at brandon@fightful.com.