We’re at the dawn of the skinny bundle era for pro wrestling.

Not that many years ago the prevailing thought was, without a traditional television program, a pro wrestling company couldn’t get off the ground and be anything but a small indie for its local area. I still even hear from some local-level indie promoters who talk about wanting to get on public access TV. To be sure, we’re still in a world where nobody without TV is going to compete with WWE, but things have changed, and the roots of the niches have been nourished by the internet and have grown deeper.

When I did a similar report a year ago, several super indies had just started their own individual video on-demand services, mimicking the WWE Network which launched in February 2014. The introductions of those services have been met with varying success. Two promoters at the time said they were disappointed in the results, as subscription rates to their paid services were low.

At the time, the most high-profile indie VOD service, Gabe Sapolsky and Sal Hamaoui’s World Wrestling Network (WWNLive) didn’t offer any kind of subscription that would grant access to all of the events within WWN’s umbrella of promotions. Instead WWN provided live iPPVs and VOD for individual events at a minimum per event price of $9.99 or $14.99, depending on whether you bought at least a day in advance. These events are believed to have sold a few hundred buys per event.

While some promotions that started VOD services have gotten a fair amount of attention among wrestling fans who follow the indies, it appears none of them were able to generate much more than modest amounts of revenue on their own.

Combining multiple promotions together into a “skinny bundle” service targeted at indie wrestling fans should be a better model, if one whose ceiling is the base of niche fans interested in wrestling products beyond what’s found on traditional TV -- an audience that it’s reasonable to expect will grow with time as technology develops and the internet becomes even more ubiquitous.

At the tail end of 2016 there are at least two organizations getting into the pro wrestling skinny bundle business.

FloSports announced in October the launch of FloSlam and the acquisition of rights to WWN’s events. FloSports is a video streaming service with many years of experience in broadcasting niche sports online. FloSlam is continuing to pursue independent wrestling companies from around the world. Besides the WWN brands, they’ll also broadcast events for Tommy Dreamer’s House of Hardcore, North Carolina-based Pro Wrestling Xperience and IPW:UK. Subscriptions will cost either $20 per month or $150 for year-long commitment.

Powerbomb.tv is an upstart founded by Adam Lash who’s worked with indie wrestling content for years, including operating the Indie Wrestling Archive YouTube channel. Powerbomb.tv however, like FloSlam, will be a paid subscription service and has already signed on numerous small independent promotions. Price points are $9.99 per month, $49.95 for six months or $99.99 for twelve months.

Which promotions should these services be thinking about signing on?

Social media followers are flawed indicators as to which promotions have the most value. The numbers can be enhanced with paid ads and with some borderline- or outright nefarious manipulations. However if they are not perfectly indicative, and while other factors should be considered when trying to make a determination about which promotions are most popular, social media follower counts are at least suggestive of which promotions have the furthest reach and the most interest.

I would also caution that these numbers are suggestive of familiarity, but not necessarily favorability. I believe it’s important to distinguish between familiarity and favorability when considering the value of these niche wrestling products. In other words, a fan’s awareness of a promotion doesn’t necessitate a fan’s willingness to pay for its products.

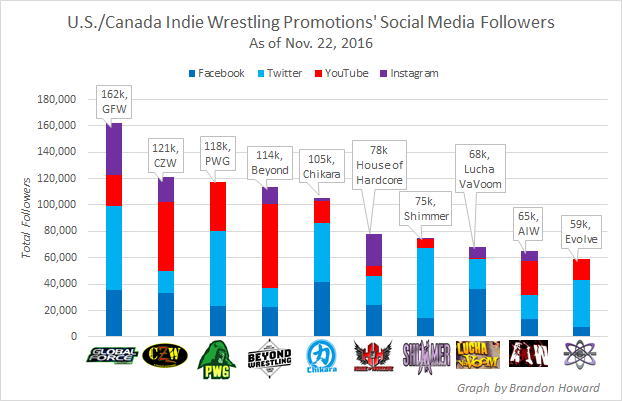

U.S. and Canadian Indie Promotions

Jeff Jarrett’s Global Force Wrestling is compared here to other U.S. indies. In previous reports of this kind, GFW was compared to TNA, ROH and Lucha Underground, all of which now exceed GFW for total followers several times over. GFW’s total follower count is more comparable to other top U.S. indies.

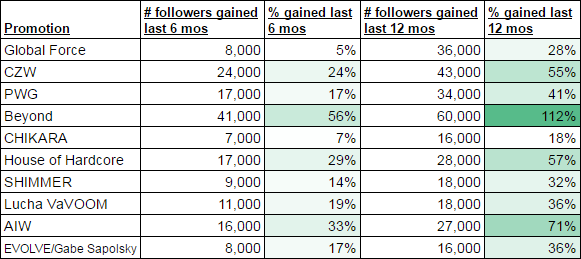

GFW is followed by Combat Zone Wrestling, which continues to do well on all platforms, especially YouTube. Pro Wrestling Guerilla’s total would be higher and could exceed CZW if PWG it had an Instagram account. Beyond Wrestling continues to see huge growth on YouTube subscribers, which had it closing in on PWG. Chikara ranks high despite slower growth than its peers. House of Hardcore, Shimmer, Lucha VaVOOM, Absolute Intense Wrestling and Evolve (counting Gabe Sapolsky’s Twitter and Facebook account and Evolve’s YouTube account) close out the top ten.

Again, this is merely suggestive to the value of each promotion’s content. I believe PWG and Evolve are the two most valuable properties listed above and that GFW is significantly weaker.

Whatever traction or investment GFW had in social media has waned in the last six months. For most of the year, Jarrett’s promotion ran events by co-promoting with a local promotion.

Beyond had the greatest increases in followers by percentage. Most of those were on YouTube. Beyond’s YouTube subscribers over the last six months nearly doubled and followers over twelve months tripled.

Chikara ranks highly but used to rank higher. The promotion is still among the top companies for followers, but as its brand cooled, especially following a hiatus of about one year over 2013 and 2014 when many fans were led to believe the company legitimately went out of business.

The outlier among this group of promotions seems to be Lucha VaVOOM. The promotion has run four shows in the last seven years, according to cagematch.net. Despite its relatively large social media footprint, it’s doubtful as many wrestling fans are as familiar with this promotion as its follower count would indicate.

Again, social media followers are not at all necessarily organic. They can be enhanced with paid advertising, various bots that help you gain followers and so on.

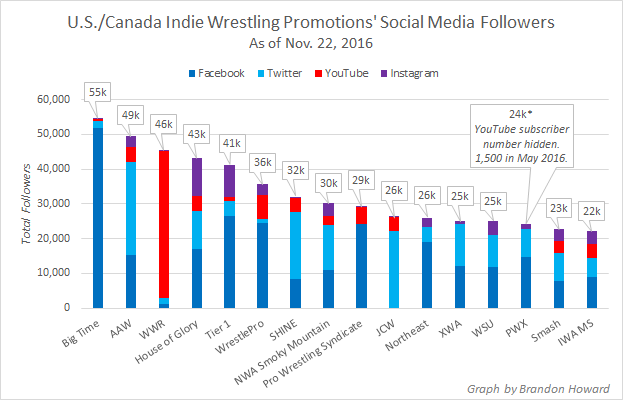

What about others outside of this top ten? As best I could find, these are the remaining 16 U.S. or Canadian promotions with at least 20,000 followers across the four major platforms.

AAW ranks below Big Time Wrestling, but has a more well-balanced followership across the platforms. Big Time’s social media presence is almost completely on Facebook, where it’s easiest to buy ads to gain followers.

Likewise, WWR has a disproportionate share of YouTube subscribers with small followings on other platforms. WWR took over WSU’s YouTube channel as part of a business deal between Beyond and CZW. Notice WSU now has no YouTube channel of its own.

WrestlePro splintered off from New Jersey promotion Pro Wrestling Syndicate earlier this year. For a time WrestlePro took over the Twitter account that previous belonged to PWS. In May that account had over 8,000 followers. That account has since been sold to a wrestling action figure website. WrestlePro opened a new Twitter account in July which currently has about 1,000 followers. PWS may be done as a promotion; it has no future dates listed its website.

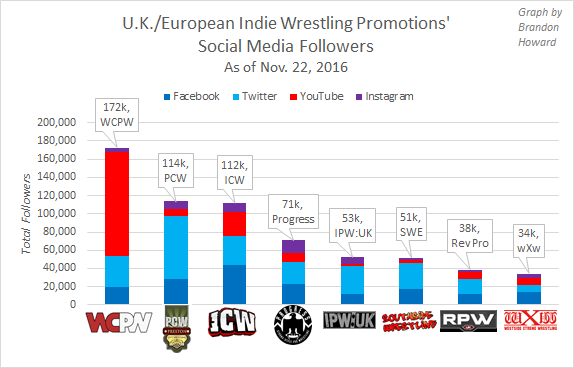

U.K./European Indie Promotions

Arguably even more than in the U.S., the popularity of indie wrestling in the United Kingdom is growing.

What Culture Pro Wrestling’s total followers already exceed that of any U.S. or U.K. indie. The promotion only ran its first show in June. The WCPW YouTube channel, and the promotion overall, has obviously benefited from What Culture’s pre-existing presence in wrestling media. What Culture is a popular website that’s existed since 2006, focusing on many aspects of pop culture; pro wrestling is one subject it focuses on heavily. The company has various YouTube channels, including one dedicated to wrestling in general (especially WWE) which may have 1 million subscribers by the time you read this. As noted, earlier this year the company, based in the U.K., decided to parlay its captive wrestling audience online into an actual wrestling promotion.

After WCPW, Preston City Wrestling ranks second. PCW which has a large following on Twitter. However that large following is likely enhanced by the even higher number of accounts it follows. Following a large number of other users on Twitter is a strategy many use to raise their own follower counts. If we eliminate everyone’s Twitter followers from the above graph, PCW would rank behind ICW and Progress.

Early results from a survey I did shortly after starting research for this article suggests Progress and Rev Pro are under-represented here, in terms of familiarity and favorability among fans.

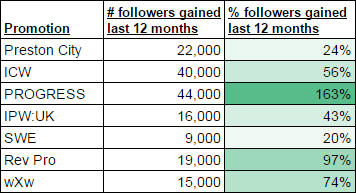

To further support that, if we look at the percentage of followers gained in the last twelve months, Progress and Rev Pro have made the greatest strides.

(WCPW is omitted here simply because it didn’t exist twelve months ago.)

By this time next year, World of Sport Wrestling may be in this conversation as that brand may be making its return soon to ITV, one of the U.K.’s most accessible TV networks.

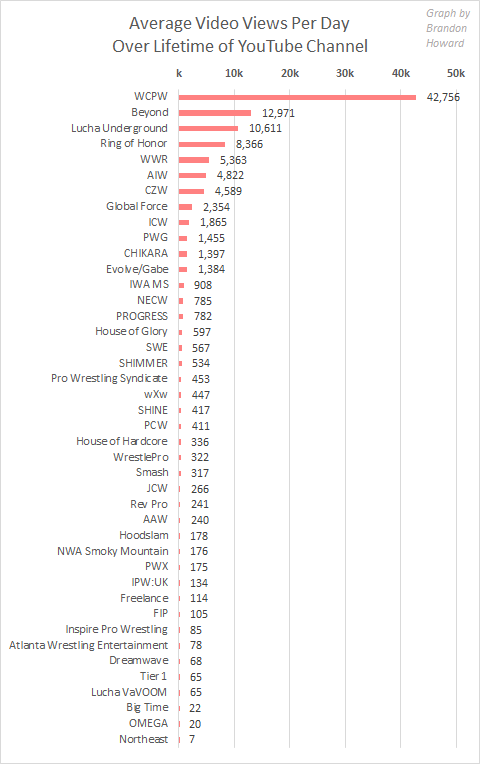

Another way to consider the value of a brand’s video content is to look at YouTube views. So I collected data on each of the aforementioned promotions’ YouTube video views for the lifetime of their channels and divided that total by the number of days since the channel was registered. This gives us a picture of each promotions’ average YouTube video views per day.

The above is by no means a complete ranking of the most viewed YouTube channels belonging to indie wrestling promotions. The most popular ones however are likely here, and we get an idea of how the other promotions discussed in this article compare.

It’s possible to buy YouTube views, although there’s little way of confirming which if any of the promotions above have participated in that. There are apparently services out there that will help customers increase their YouTube views. YouTube tries to detect such activity and if discovered makes its users pay back any associated ad revenue sharing. According to YouTube’s help page, use of third-party services to increase views could result in disciplinary action for the offending account.

WCPW is already way of everyone else here too. To be clear, the above data point for that promotion reflects the YouTube channel specifically dedicated to the wrestling promotion What Culture Pro Wrestling and not the more popular general What Culture Wrestling YouTube channel. However on the promotion’s channel, the company uploaded a video on “10 Most Unique Tactics Ever Used In A Royal Rumble”, a video more along the lines of what you’d find on What Culture’s general wrestling channel. The video has gotten over 1 million views. Perhaps this was a strategy to help get the promotion’s channel more exposure and subscribers. That video alone currently accounts for about 12% of all views on the channel. Most of the other most popular videos on the channel however are related to the promotion’s original content.

It’s interesting to see Beyond roughly triple its next two closest peers, CZW and AIW. Taken at face value, this means Beyond is more popular on YouTube than either Ring of Honor or Lucha Underground (which average about 8,000 and 11,000 views per day, respectively), despite having about half the number of YouTube subscribers. If organic, that’s an impressive feat.

Beyond told us it’s never paid for any advertising on YouTube or for any advertising to promote its individual videos, nor has it used third-party services to boost video views.

Lucha VaVOOM averages just 65 video views per day, which speaks to its misleadingly high number of followers across social media.

In our next article on pro wrestling and new media, we’ll look at Powerbomb.tv and FloSlam in more detail. You can follow Brandon on Twitter at @adecorativedrop.